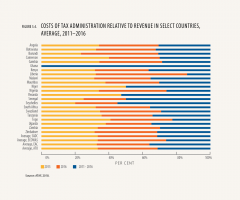

African countries have made extensive efforts to improve the effectiveness and efficiency of tax administration. These efforts need to be sustained and strengthened, especially in promoting tax compliance.

While each country also needs to address its unique challenges in tax administration, all of them need to strengthen the use of data to inform decision making and improve the efficiency and effectiveness of tax administration. One promising tool to guide these efforts is the Tax Administration Diagnostic Assessment Tool (TADT).

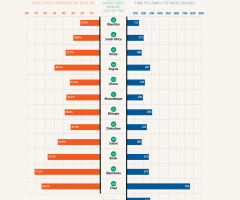

Countries should take full advantage of the opportunities for greater efficiency and effectiveness offered by digitalization. So far, 18 African countries have introduced electronic tax filing and payment systems. Rwanda was able to boost tax revenue by 6 per cent through such measures, suggesting the large scope for revenue gains in countries that have not yet done so. In South Africa, e-taxation lowered the time (by 21.8 per cent) and cost (by 22 per cent) of complying with the value-added tax (VAT). In Kenya, digitization of VAT operations helped identify data inconsistencies and raised VAT collections by more than $1 billion between 2016 and 2017