By Adam Elhiraika, Wafa Aidi, Oumaima Tounchibine, and Amged B. Shwehdy

Executive Summary.

Small and medium-sized enterprises (SMEs) in North Africa represent both the backbone of the economy and a critical lever for inclusive growth. Recent pre-workshop assessments conducted by the United Nations Economic Commission for Africa, Sub-Regional Office for North Africa (UNECA SRO-NA), highlight critical knowledge gaps in Tunisia and Libya. The assessment covered two selected cohorts: 26 SMEs in Tunisia and 9 SMEs in Libya. The Tunisian group, which comprises 31% women-led and 42% youth-led enterprises, demonstrates strong digital momentum but weak export potential, with men predominantly holding executive posts, while women often assume leadership through ownership and self-created ventures (See Figure 1). The Libyan cohort achieved near gender parity, but only 12.5% of youth leaders, reflecting a more mature founder base constrained by fragile access to finance and limited awareness of the AfCFTA, despite promising entrepreneurial models (See Figure 1). Taken together, the 26 and 9 SMEs provide a demographic snapshot of North African entrepreneurship: diverse and dynamic, yet still limited by gaps in finance, export readiness, and structured support for expansion.

Figure 1: Gender and Age Distribution of Tunisian and Libyan SMEs

| Indicator | Tunisian SMEs | Libyan SMEs |

|---|---|---|

| Gender | 31% Women, 69% Men | ~50% Women & ~50% Men |

| Youth SMEs (<=40) | 42% (11 out of 26) | 12.5% (1 out of 9) |

| Women-led SMEs | 31% (8 out of 26) | ~50% (≈4 or 5 out of 9) |

| Male-led SMEs | 69% (18 out of 26) | ~50% (≈4 or 5 out of 9) |

| Women as Founders/Owners | 3 out of 8 women | Several women in leadership through ownership roles (exact share not specified) |

| Men as Direction roles (CEO/PDG) | ~80% of men | More prevalent among mature leaders (majority of senior posts) |

From Gaps to Gains: Turning SME Assessments into Tailored Training and Real Results

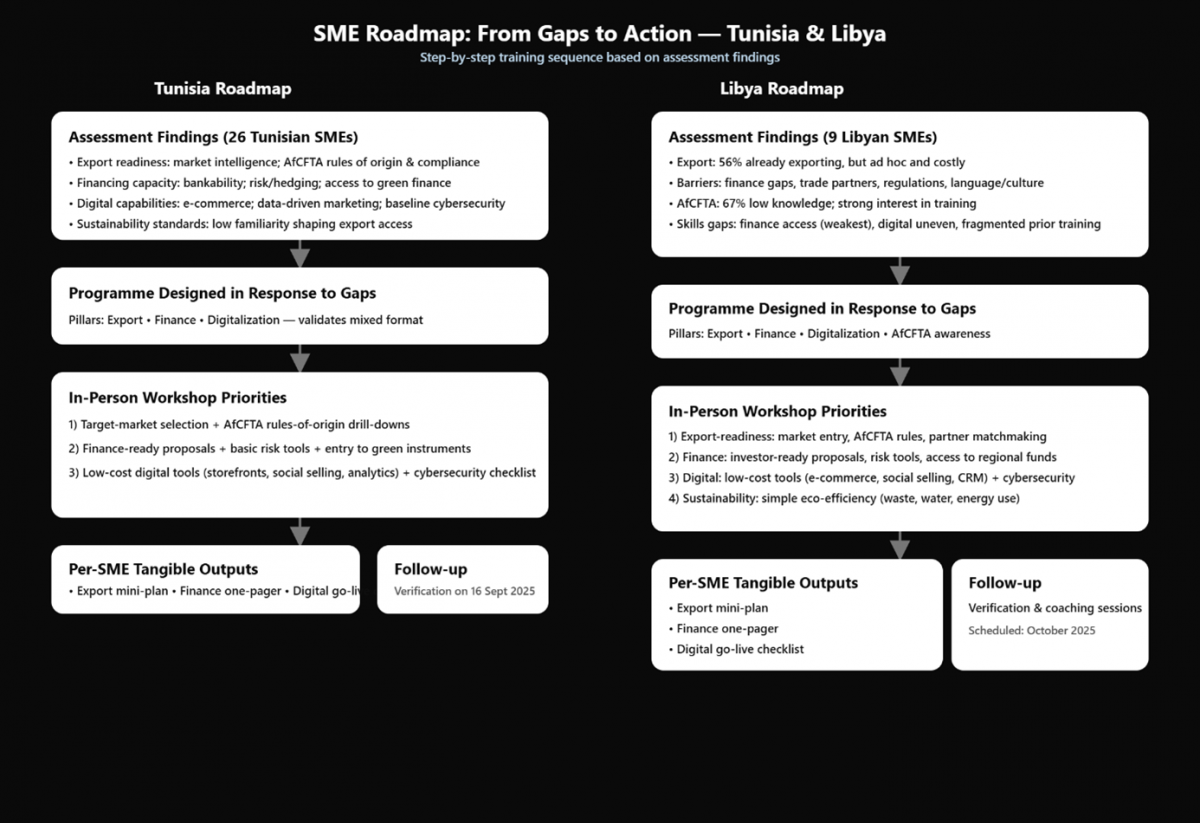

Figure 2 illustrates the step-by-step process that links SME diagnostic assessments with programme design and workshop priorities:

Figure 2: SMEs program for Tunisian and Libyan SMEs

Results of the SME Assessments in Tunisia and Libya

Current status of SMEs and their activities

Our assessments confirm that SMEs in both countries are predominantly micro or small firms with lean organizational structures. In Libya, more than half of the surveyed businesses employ between one and five workers, while only a minority have between 6 and 20 staff. Tunisia displays a similar profile, with almost 85% of the sample employing fewer than 10 workers. Sectoral patterns also converge. In Libya, 46.2% of the cohort is employed in industry, encompassing food processing, spice packaging, metal recycling, and renewable energy. Commerce accounts for 23.1 %, while services and crafts share the remainder. Tunisia presents a broader sectoral base, but remains industry-led, with eight of the 26 firms belonging to the manufacturing and processing sector, followed by niche participation in agriculture, services, and tourism.

Capabilities and knowledge gaps

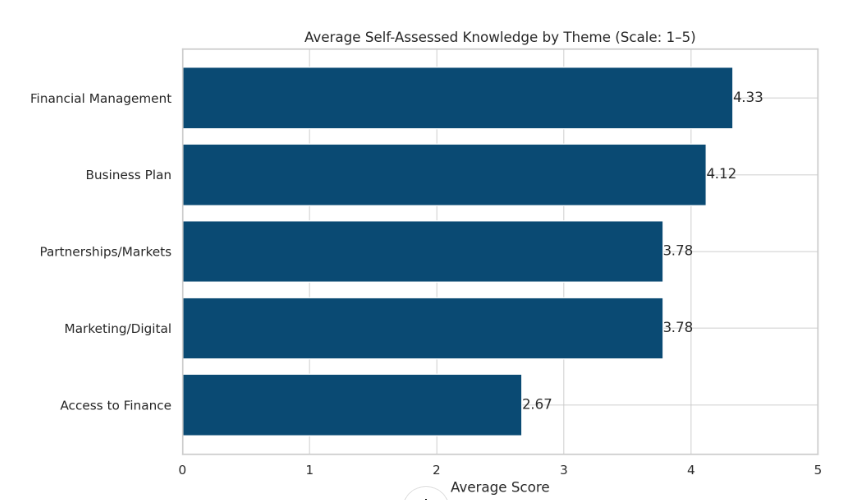

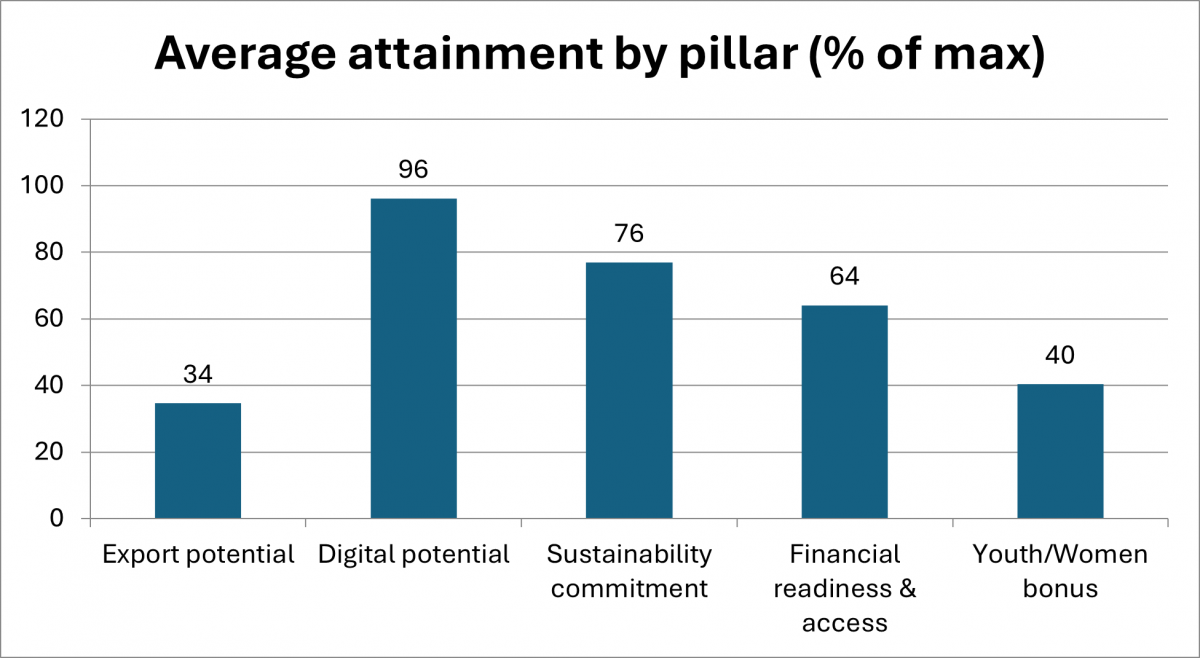

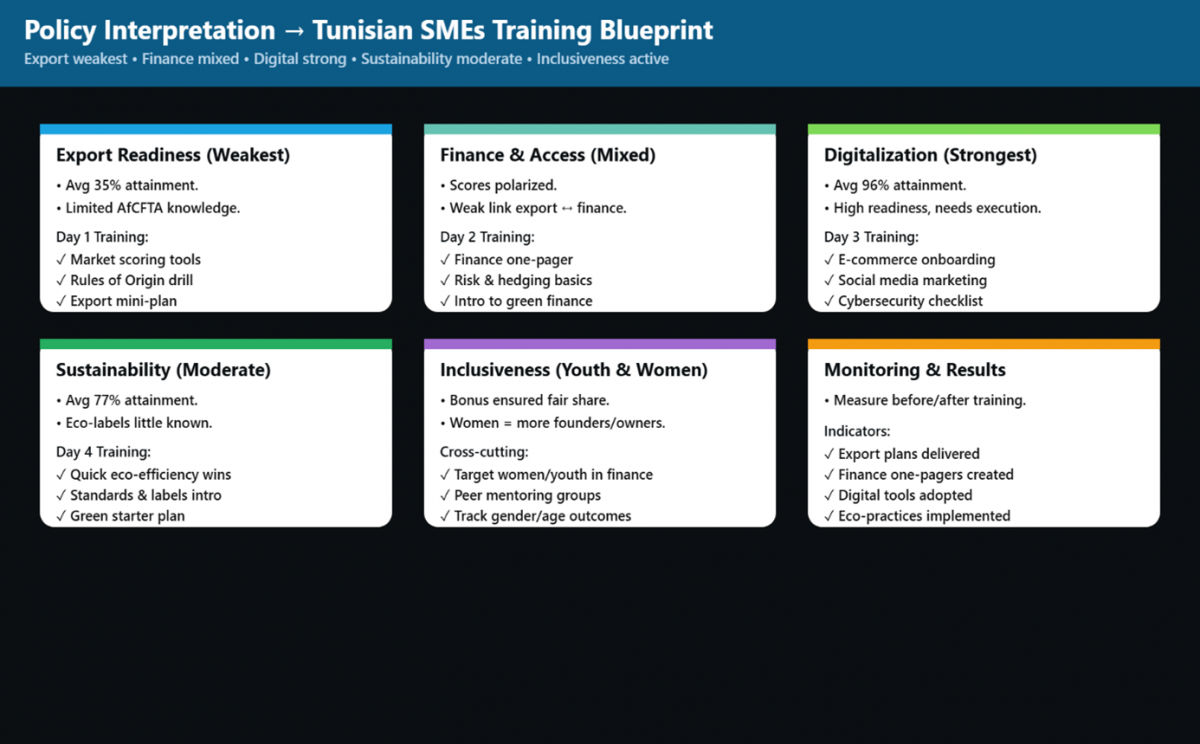

The self-assessment scores confirm different but complementary weaknesses across the two contexts. In Libya, access to finance is the weakest dimension (2.67/5), reflecting difficulties in securing credit and limited confidence in financial instruments. Marketing and digital capacities are modest (3.56/5), while export readiness is moderate but still significant (3.78/5). Business planning (4.11/5) and financial management (4.33/5) show relative strength, though often limited to basic accounting rather than investor-ready planning (See figure 3). In Tunisia, export potential is the weakest pillar (34.6% of the maximum), digital potential is the strongest (96.1%), and sustainability registers moderately high (76.9%). Financial readiness is mixed (64.1%), with several firms maintaining sound records, but others lacking basic bookkeeping (see Figure 4). This uneven landscape highlights the need for Libyan SMEs to receive urgent support in finance and digitalization, while Tunisian SMEs require structured pathways into international markets.

Figure 3: Knowledge Gaps Assessment Results for Libyan SMEs

Figure 4: Knowledge Gap Assessment Results for Tunisian SMEs:

AfCFTA awareness and export orientation

The most striking gap is the lack of knowledge about AfCFTA. In Libya, 66.7% of SMEs report low awareness, with only 22.2% demonstrating a medium understanding and 11.1% possessing high knowledge. This lack of familiarity prevents firms from translating existing export activity into structured regional integration. Tunisia’s SMEs also display a limited understanding of rules of origin and trade compliance, a challenge that constrains their strong digital and sustainability potential. Despite these gaps, 56% of Libyan SMEs are already engaged in exporting, although primarily through informal brokers and personal networks. Tunisian SMEs show export ambition but lack market intelligence and structured distribution channels.

Figure 5: Tunisia SME Knowledge Gap Assessment & Training Blueprint, 2025

Figure 6: Libya SME Knowledge Gap Assessment & Training Blueprint, 2025.

![[Blog] From opportunity to action: Empowering SMEs in Libya and Tunisia through AfCFTA](https://www.uneca.org/sites/default/files/styles/slider_image/public/storyimages/shutterstock_1939209241_1920x640.jpg?itok=P8ZREjUI)